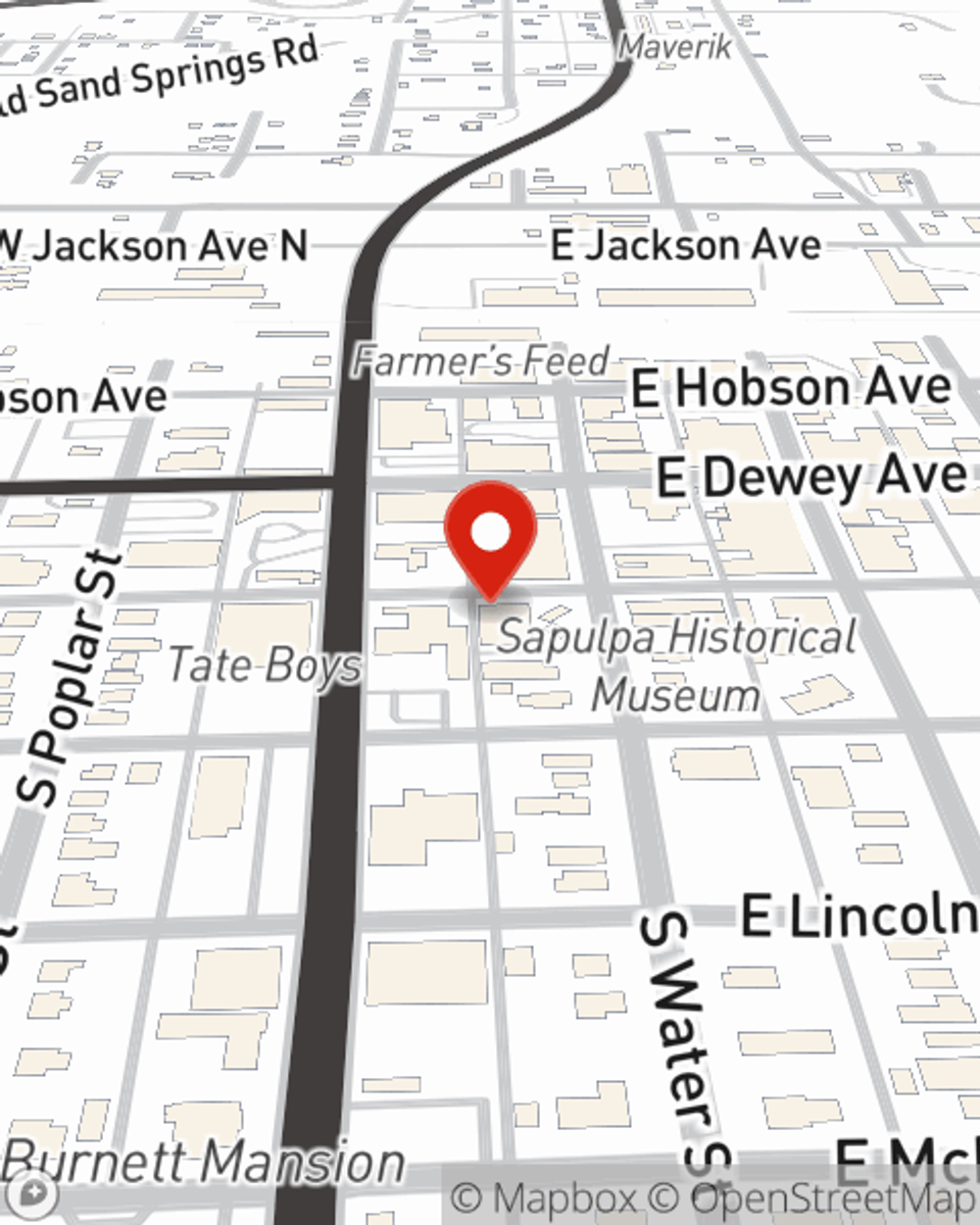

Business Insurance in and around Sapulpa

Get your Sapulpa business covered, right here!

Helping insure small businesses since 1935

- Sapulpa, OK

- Kiefer, OK

- Tulsa, OK

- Kellyville, OK

- Mounds, OK

- Glenpool, OK

- Sand Springs, OK

- Berryhill, OK

Help Prepare Your Business For The Unexpected.

When experiencing the wins and losses of small business ownership, let State Farm be there for you and help provide outstanding insurance for your business. Your policy can include options such as business continuity plans, extra liability coverage, and a surety or fidelity bond.

Get your Sapulpa business covered, right here!

Helping insure small businesses since 1935

Protect Your Business With State Farm

Whether you own a floral shop, a veterinarian or a lawn care service, State Farm is here to help. Aside from exceptional service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Contact agent Rebecca LaFevers to consider your small business coverage options today.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Rebecca LaFevers

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.